Looking to start or grow your business in Punjab? Chief Minister Maryam Nawaz Sharif’s Karobar Card Loan Scheme, officially known as the Asaan Karobar Card (AKC Punjab), is offering interest-free loans of up to PKR 1 million to small and medium business owners in the province.

Here’s everything you need to know — eligibility, step-by-step application process, benefits, repayment terms, and pro tips to get approved.

✅ What Is the Asaan Karobar Card (Maryam Nawaz Loan Scheme)?

The Asaan Karobar Card is a zero-interest SME loan program for entrepreneurs in Punjab. It provides a digital revolving credit facility for business-related expenses with easy repayment and no interest charges.

🔑 Key Features of the Karobar Card Loan

| Feature | Details |

|---|---|

| Loan Amount | Up to PKR 1,000,000 |

| Tenure | 3 years (12-month revolving credit) |

| Repayment Period | 24 equal monthly installments |

| Grace Period | 3 months from card issuance |

| Interest Rate | 0% (interest-free) |

| Cash Withdrawal | Up to 25% of loan limit |

| Eligible Expenses | Vendor payments, utilities, taxes, and working capital |

🧾 Who Can Apply? Eligibility Criteria

To qualify for the Maryam Nawaz Karobar Card:

-

Must be a Pakistani citizen aged 21–57 years

-

Must reside in Punjab with a valid CNIC

-

Must own an existing or proposed business in Punjab

-

Must have a clean credit history

-

Must pass a credit and psychometric assessment

-

Only one application per person/business is allowed

📝 How to Apply Online for Maryam Nawaz Loan Scheme – Step-by-Step Guide

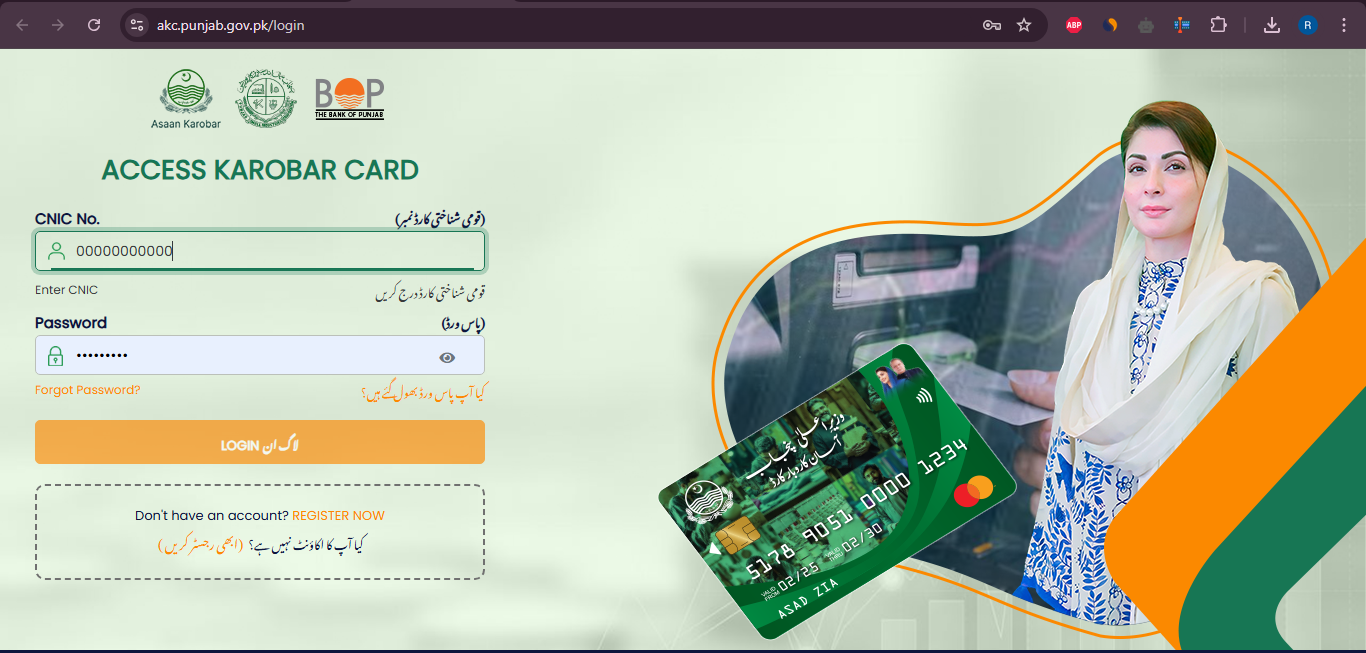

Step 1: Register on the Official Portal

➡ Visit: https://akc.punjab.gov.pk/login

➡ Click “Register Now” and enter:

-

CNIC-registered mobile number

-

Personal details (Name, CNIC, Date of Birth)

-

A strong password (8+ characters, use a capital letter, number & special character)

Step 2: Fill the Application Form

After login, complete these sections:

-

Personal Info – Address, education, experience

-

Business Details – Nature of business, revenue, employees

-

Loan Amount – Choose between PKR 100,000–1,000,000 (Auto-selected as “Working Capital”)

Step 3: Upload Required Documents

-

Front/back of CNIC

-

1–2 years bank statements (optional but recommended)

Step 4: Pay PKR 500 Processing Fee

-

Use your 19-digit PSID generated on the portal

-

Pay via mobile banking, ATM, or bank counter (Select 1Bill – Invoice/Fixed Payment)

Step 5: Submit Your Application

✅ Review everything

✅ Hit “Submit”

✅ Save the confirmation message for tracking

📌 If “Submit” is disabled, your form is already submitted.

💳 Loan Disbursement & Repayment Rules

-

First 50% of funds released immediately (must be used within 6 months)

-

Second 50% released after consistent repayments + PRA/FBR registration

Repayment Schedule:

-

3 months grace period (no payments)

-

Then, repay 5% of principal monthly

-

Final 2 years: repay in 24 equal installments

📌 Funds are strictly for business use only

📌 PRA registration mandatory within 6 months

💸 Fees, Charges & Coverage

| Type | Details |

|---|---|

| Annual Card Fee | PKR 25,000 + FED (deducted from loan) |

| Processing Fee | PKR 500 (non-refundable) |

| Coverage Included | Life insurance, card issuance/delivery |

| Late Payment Charges | As per bank policy |

📞 Need Help?

For assistance, call the Asaan Karobar Helpline at 1786.

📌 Final Tips Before Applying

-

Keep your CNIC and business documents ready

-

Double-check details before submitting

-

Explore business feasibility reports on PSIC and BOP websites to strengthen your plan

💡 FAQs – Maryam Nawaz Karobar Card Loan Scheme

Q. Is the loan really interest-free?

Yes, it’s completely interest-free for the entire tenure.

Q. Can I apply without a registered business?

Yes, proposed businesses are allowed, but a strong business plan helps.

Q. How soon will I get the funds?

The first half of the loan is released soon after approval and card issuance.

Q. Can I reapply if rejected?

Currently, only one application per person is allowed.

🚀 Empower Your Business with 0% Interest

The Maryam Nawaz Karobar Card is a game-changer for Punjab’s entrepreneurs. Whether you run a shop, salon, food business, or startup — this scheme gives you the financial freedom to start, sustain, or scale your dream business without the burden of interest.

👉 Apply now at https://akc.punjab.gov.pk and take charge of your future!